You can support the organizations and causes you care most about today and after your lifetime, all while maximizing your financial and tax advantages.

A designated fund allows you to support your favorite charity or charities with annual gifts that continue beyond your lifetime. Through a designated fund, we can award grants to qualified 501(c)(3) public charities located anywhere in the United States.

You ask the Foundation to send the income from your Fund to your selected charities, specifying the amounts or percentages for each. We will take care of all the administration, including determining eligibility and distributing the donation in your name.

If one of your selected organizations ceases to operate or provides a type of service that no longer interests you, we can help find one that does – so that your gift is kept alive and meaningful year after year.

As I was doing estate planning, my lawyer suggested that if I wanted to create a fund, I should start now. Foundation staff were great to work with and guided me in creating a designated fund. Its grants will support the causes I care about, such as nurturing our region’s natural and cultural resources.

-

Anonymous

Quick Facts

- Minimum Size: $10,000. No maximum.

- Permanence: Option to establish a permanent or unrestricted fund.

- Spending Policy: Permanent funds have a 4.0% payout rate.

- Recognition: Gifts from your fund can be anonymous upon request.

- Location: Grants can be made to any qualified charitable organization in the U.S.

- Fees:

- Annualized support fee: 1.25% of fund’s total market value.

Balances above $5 million are charged a reduced 1% support fee. - Investment fee: 0.90% of fund’s market value.

Frequently Asked Questions

How can Greater Worcester Community Foundation help?

As a qualified 501(c)(3) public charity, the Greater Worcester Community Foundation offers the maximum deductibility for income, gift and estate tax purposes. The fund is commingled with other funds in one of two portfolio options, both designed to ensure preservation and growth of principal and a dependable source of revenue for distribution and expenses. The Foundation handles all of the administration.

Once the Fund is established may I or others make additional gifts to it?

Yes. Once a Fund is created, additional gifts of any amount may be contributed to it at any time.

How often will I receive information about the Fund?

When you open your fund, you will receive access to our online fundholder portal. Through the portal you will be able to view financial information, monthly fund statements and when grants are sent.

Can you send me the grant check to give to the charity?

We are not able to send grant checks to the Donor or any party other than the organization. Checks are mailed directly by the Foundation to the nonprofit.

If I have questions about a particular charity or want to find an effective organization working in an area of interest, can you help me?

Yes, we can. Our Program Team will be happy to share their knowledge with you and assist you in any way possible.

What happens to my Designated Fund after I die?

We hope that the Fund will continue after your lifetime. The Fund is typically maintained as permanently endowed in your name.

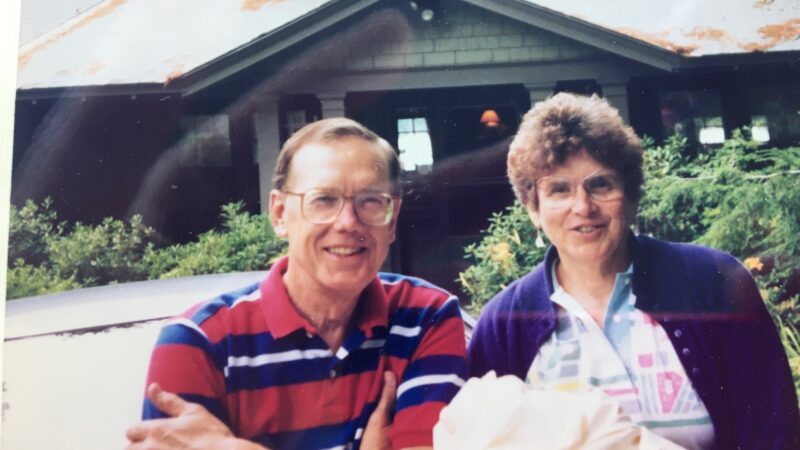

The Mary Oakley Memorial Fund

This designated fund will honor Mary Schwartz Oakley (1932 –2021) in perpetuity by making grants that provide art supplies for children in the Worcester Public Schools.

“This was Mary’s wish for years,” says Joseph C. Oakley, a retired dentist, who met his wife of 64 years at a Halloween party at Mass General, where she was a dietetic intern and he was a Harvard dental student. “Mary felt that many kids lacked the opportunity to develop their artistic interests.”

A registered dietitian in the Worcester Public Schools, Mary later owned and ran a needlework store, sharing with the public her lifelong love of needlepoint, sewing, and quilt making.

Our three children and I decided that providing supplies to help children develop their artistic interests would be a fine way to honor Mary’s life. And by making these grants through the Foundation, we are confident that the money will go to the right place.

-

Joseph C. Oakley