Giving

We offer three investment portfolios, each with their unique objectives and benefits.

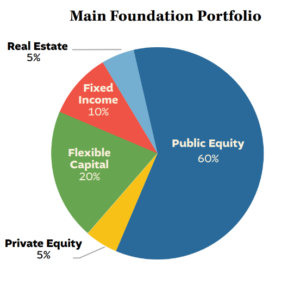

Main Foundation Portfolio

- Investment Objective: Capital preservation and long-term asset growth to meet spending after inflation

- Liquidity: 5% illiquid private investments

- Expected Nominal Return and Volatility1: 7.8 / 12.7

- Estimated Management Fees2: 65 – 75bps

- Potential Benefits: Long-term growth to meet incremental charitable spending needs and expenses

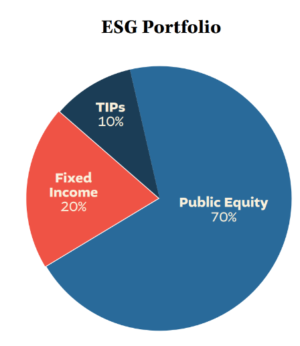

ESG Portfolio

- Investment Objective: Capital preservation and long-term asset growth, with a focus on sustainability including fossil fuel free investments

- Liquidity: 100% daily liquidity

- Expected Nominal Return and Volatility1: 7.2 / 12.0

- Estimated Management Fees2: 40 – 50 bps

- Potential Benefits: Long-term growth investing in an environmentally-oriented portfolio

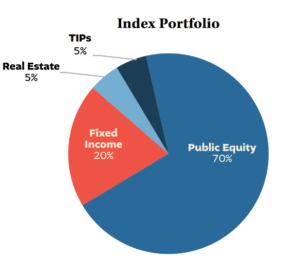

Index Portfolio

- Investment Objective: Capital preservation and long-term growth, investing in passively managed index funds to minimize fees

- Liquidity: 100% daily liquidity

- Expected Nominal Return and Volatility1: 7.4 / 12.7

- Estimated Management Fees2: 5 – 7 bps

- Potential Benefits: Low cost passively managed portfolio seeking long-term growth via well- diversified market exposures

1Expected returns and volatility, as measured by standard deviation, are based on Prime Buchholz 2024 capital market assumptions. Returns are geometric. As of December 31, 2023.

2Management Fees represent investment manager fees only and exclude custody and Prime Buchholz advisory fees (approximately 8-10 bps).

Investment Pool Options - Target Asset Allocations

For more information about our investment pool allocations, please download the document below.

Questions?

Contact Kelly Stimson

Vice President of Philanthropic Services

508-755-0980 ext 112